ENHANCED GELFAAM GMBIS with Hospitalisation Benefits

FINANCIAL PROTECTION FOR RM60 / RM120 MONTHLY PREMIUM

|

Benefit

|

Sum Assured (RM) @ RM60 Monthly

|

Sum Assured (RM) @ RM120 Monthly

|

|

Death Benefit due to accident

up to age 70 |

100,000.00 + AF

|

200,000.00 + AF

|

|

TPD Benefit due to accident

up to 65 age next birthday |

100,000.00 + AF

|

200,000.00 + AF

|

|

Death Benefit due to sickness or old age

up to age 70 |

50,000.00 + AF

|

100,000.00 + AF

|

|

TPD due to sickness or old age

up to 65 age next birthday |

50,000.00 + AF

|

100,000.00 + AF

|

|

Living Assurance Benefit

up to age 70 |

50,000.00 + AF

|

100,000.00 + AF

|

|

Accidental Total Permanent Partial Disability

up to 65 age next birthday |

Up to RM50,000.00

|

Up to RM100,000.00

|

|

Hospitalisation Benefits

up to 65 age next birthday |

RM50/day

|

RM100/day

|

|

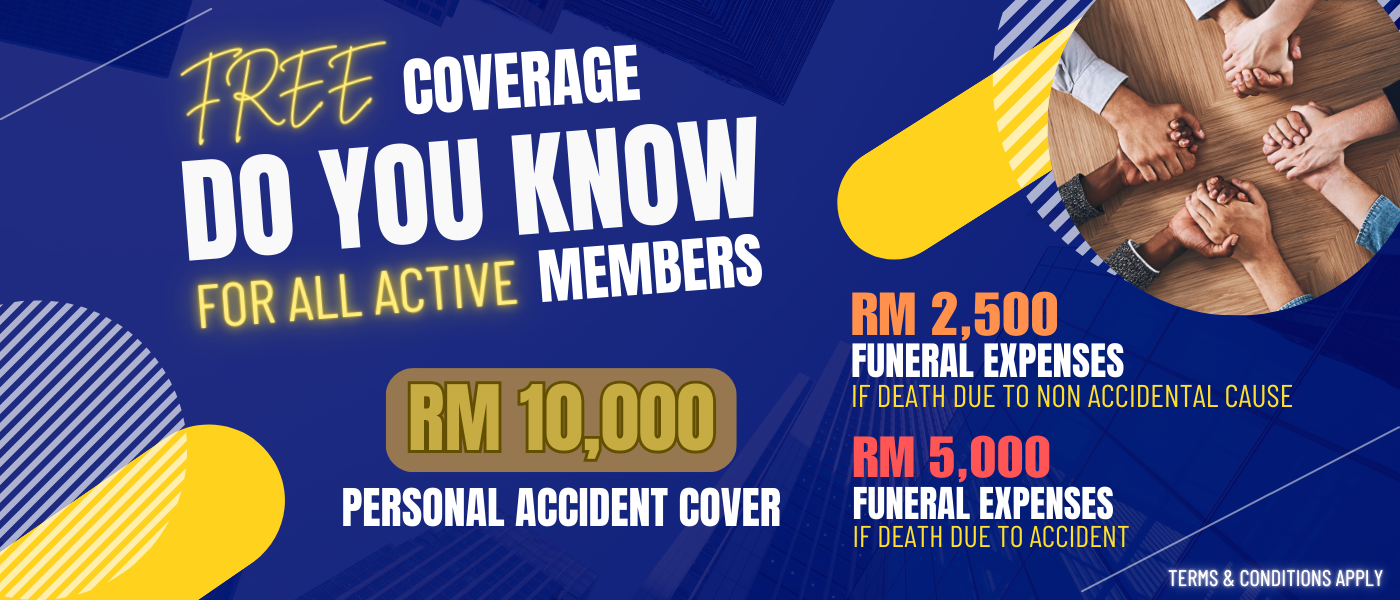

Funeral Expenses

|

RM5,000.00

|

RM5,000.00

|

- AF = Accumulated Fund, which is the current Net Asset Value of the accumulated Units to the participant s credit.

!!! ADVANTAGES OF THIS SCHEME !!!

- Level premium for all ages and easy payment through your agency account deduction

- Members can continue to participate up to age 70

- Affordable premium with comprehensive protection

- Partial withdrawal of funds is allowed

- A source of retirement benefit

- Entitled for income tax relief

- No disruption of participation even after leaving GE as agent

ELIGIBILITY AND PARTICIPATION

- Assured Members (employees/members) and their legal spouse aged between nineteen (19) to sixty-five (65) years next birthday.

- Children aged between thirty (30) days old to nineteen (19) or twenty-three (23) years next birthday for fulltime students. This is applicable for unmarried and unemployed children only.

- Coverage for dependants can only be extended if an Assured Member (employee/members) participates in the scheme.

CONDITIONS FOR CHILD PARTICIPATION

- A child can only participate in this scheme if the members participates.

- Failure in fulfilling the above requirements will result in the Life Assured’s plan being cancelled from inception and all premiums received in respect of the Life Assured will be refunded accordingly.

FURTHER DETAILS OF THE BENEFITS

Death (Age 70 ) – Natural Causes

Death And Total Permanent Disability – Accidental Causes

- Death benefit is double the amount of Death due to natural causes and covered up to age 70

- TPD benefit is double the amount of TPD due to natural causes and covered up to 65 age next birthday

- Other Permanent Partial Disability Benefits up to 65 age next birthday will be payable according to the Schedule of Compensation in the Master Policy.

Critical Illness (Living Assurance Benefit)

- This benefit will be payable once the doctor has confirmed that the member has contracted one of the 45 Critical Illnesses

- This benefit is not payable for any critical illness which has existed before the effective date or which is first diagnosed in the first 60 days from the date of Letter of Acceptance or date of first premium payment whichever is later

- Participation of member who has claimed this benefit will be automatically terminated.

Accumulated Fund Benefit

- The Accumulated Fund basing on member s total contribution under this scheme will become payable on reaching age 70 or surrender whichever is earlier.

- Participation ceases on attaining age 70.

- No Surrender Value will become payable for less than 12 monthly premiums made

Funeral Expenses – RM5,000.00 is payable for Death Claim

Important Note:

The information in this site is for illustration purposes only. The actual terms and conditions are contained in the Master Policy.

You are strongly advised to read and understand the benefits and exclusions under the master policy held by the Association before signing this proposal form

For more information please do not hesitate to contact us at:

Tel: 03-9200 6300 | WhatsApp: 03-9200 6400

Email Address: gelfaam@gelfaam.com