GELFAAM Kota Kinabalu Branch – Mid-Year Get Together Dinner Night 2024 July 05

GELFAAM Sibu Branch – Medical Talk by Dr Heng, ENT Specialist 2024 July 06

GELFAAM Seremban Branch – Individual Bowling Tournament 2024 June 29

BNM, insurers working on new insurance policies with cost-sharing provisions

Source:

https://theedgemalaysia.com/node/713653

GELFAAM Disclaimer:

For General Awareness / Knowledge purpose only.

KUALA LUMPUR (May 30): Bank Negara Malaysia (BNM) and insurers are working on new insurance plans with cost-sharing provisions amid rising healthcare costs that will inflate claims and lead to higher premiums for consumers, an association of insurers said.

Medical claims payout increased 26% in 2023 following a 34% surge a year earlier, according to the Life Insurance Association of Malaysia (LIAM) that represents 16 foreign and local life insurers. The higher medical claims are expected to add pressure on premium increases in the future, LIAM said.

“Policyholders are provided options to manage the cost of their insurance premiums,” LIAM president Raymond Lew wrote in the association’s latest annual report. “These include lowering their premium by converting it to a cost-sharing plan and reviewing or altering their policy benefits to suit their situation.”

Repricing of premiums is a standard feature of medical reimbursement coverage but insurance policies become unsustainable when the premiums collected are insufficient to cover the expected claims expenses.

Policyholders have sought or resumed medical consultations as Malaysia recovers from the Covid-19 pandemic, leading to a sharp rise in medical claims in 2022 and 2023.

Medical claims are surging

Claims data from 2018 shows that hospital supplies and services accounted for 60%-70% of claimable surgical and non-surgical treatment costs in Malaysia, LIAM said. The costs are not regulated and are increasing faster than other hospitalisation costs, the association flagged.

The total claims payout in 2023 climbed 14.9% to RM15.4 billion in 2023 from RM13.4 billion in 2022, driven by an increase of 41.4% in disability payment and 26.2% in medical claims, data from the association show.

New business total premium, meanwhile, rose 11.6% to RM13.4 billion in 2023 from RM12 billion in 2022, thanks to strong growth in group policies and investment-linked policies.

“We look forward to a collective effort by the government, regulators, private hospitals, and consumers to address the issue of medical cost and premium inflation,” Lew said.

That includes understanding the necessity of every medical procedure, option for daycare instead of admission to hospital, request for itemised billings, and opting for co-payment to promote responsible usage of medical and health insurance and to reduce pressure on premium increases, it said.

Policyholders, meanwhile, are urged to educate themselves on their medical policies, explore alternative treatments, question unreasonable billing, and consider optimal medical treatments, LIAM added.

Source:

https://theedgemalaysia.com/node/713653

GELFAAM Disclaimer:

For General Awareness / Knowledge purpose only.

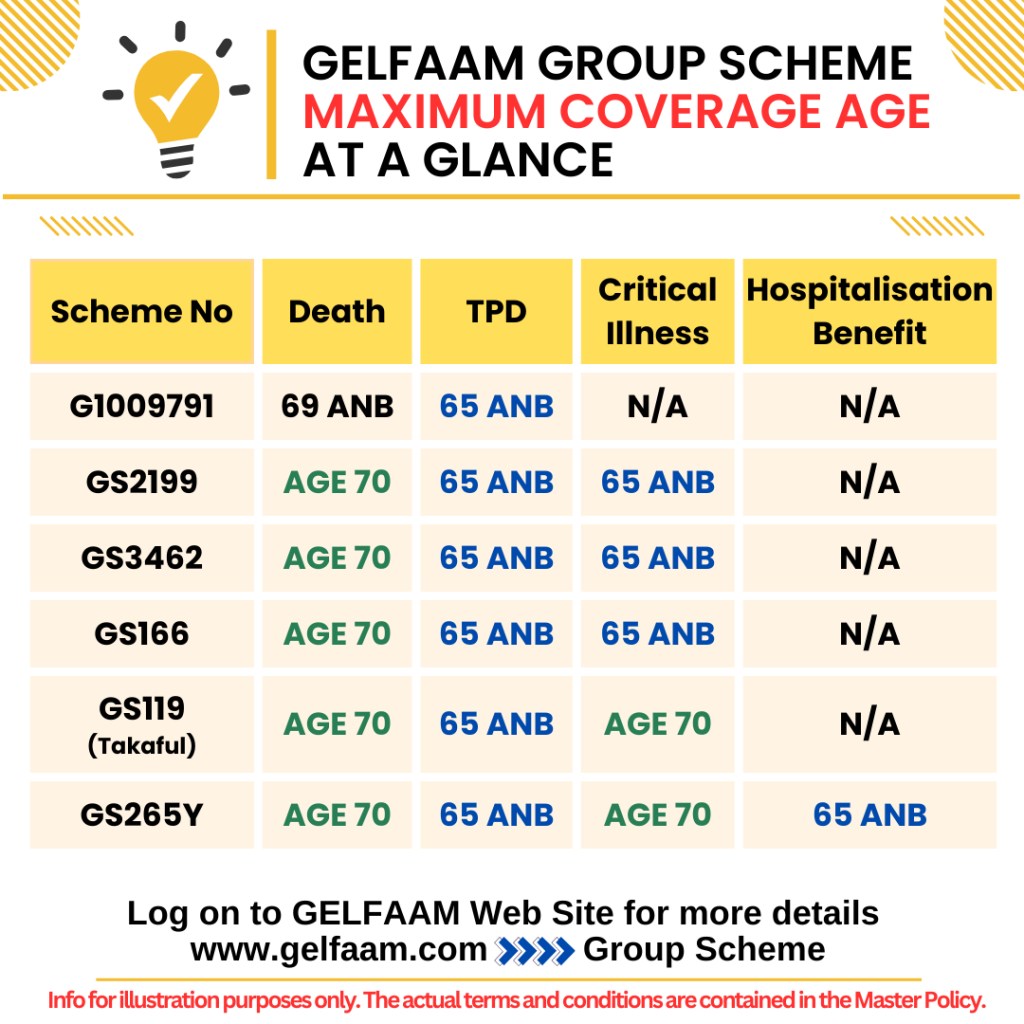

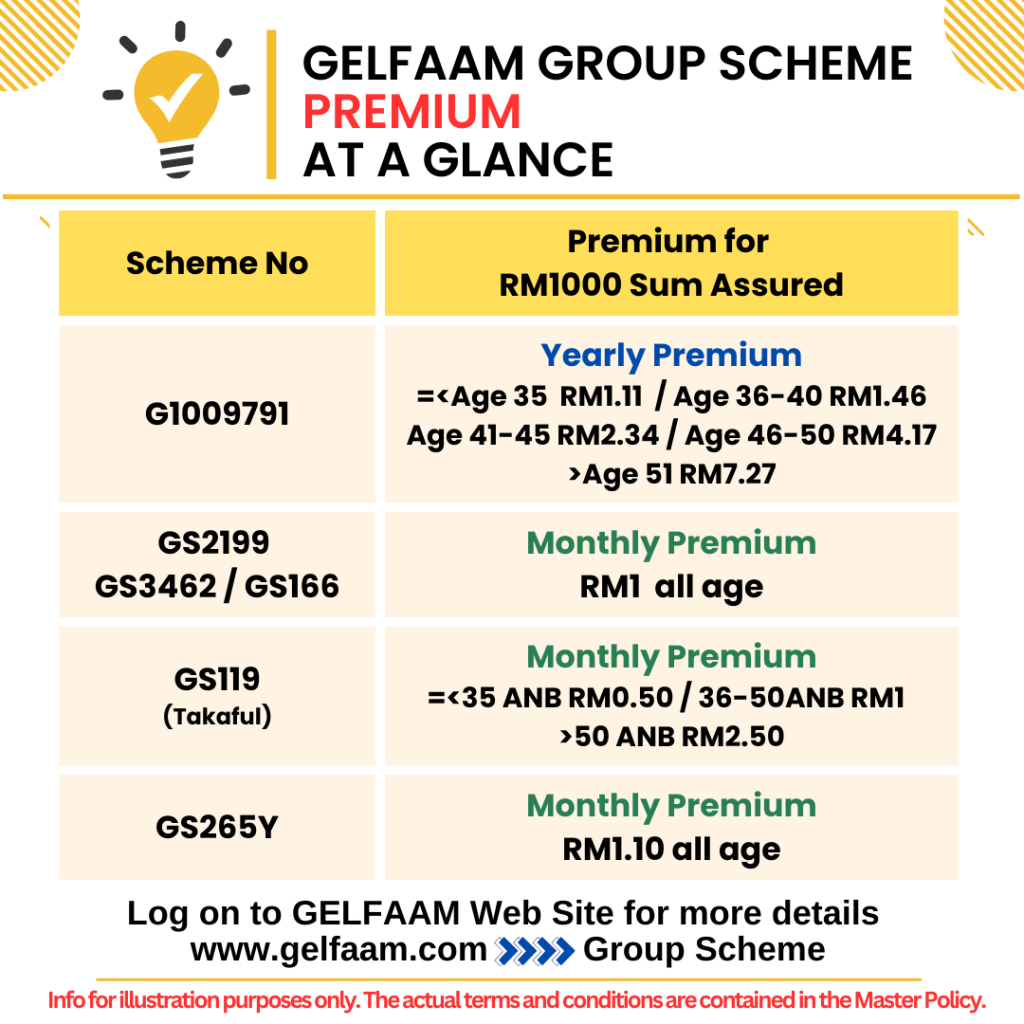

GELFAAM Group Schemes Specially Negotiated for Members

GELFAAM Group Schemes Specially Negotiated for Members

For more details

https://gelfaam.com/home/group-scheme/

LIAM Celebrates 50th Anniversary

LIAM is celebrating its 50th Anniversary this year. A line up of activities and awareness campaigns have been taking place since the first quarter of this year. Find out more at LIAM’s Anniversary microsite https://50th.liam.org.my/

GELFAAM Klang Branch Event – Membership Recruitment Day 2024 June 10

Dear Klang GMs & UMs, please encourage your newly recruited agents who have yet to receive the free Dry Fit GELFAAM’s 40th Anniversary t-shirt to come and collect on the date and time specified in the flyer. Please also encourage those who haven’t sign up as GELFAAM members to do so at the link below;

To register GELFAAM membership online at

https://gelfaam.com/home/form/new_member_login_form.php

Should private hospitals be better regulated?

Do you think you are paying more to your private medical hospital – more than you should? Do you feel some medical tests are unnecessary?

Article by GK Ganesan :

https://www.gkg.legal/should-private-hospitals-be-better-regulated/

GELFAAM Disclaimer:

For General Awareness / Knowledge purpose only.