Closed for application since 14 July 2009

Minimum

S.A. |

Maximum

S.A. |

|

Member |

RM50,000.00 |

RM300,000.00 |

Spouse/Dependants |

RM25,000.00 |

RM300,000.00 |

FINANCIAL PROTECTION FOR RM 50 MONTHLY PREMIUM

Benefit |

Sum Assured (RM) @ RM50 Monthly |

Death/TPD

Benefit

due to accident

up to 65 age next birthday |

100,000.00

+ AF + Bonus |

Death

Benefit

up to age 70 |

50,000.00

+ AF + Bonus |

TPD

Benefit

up to 65 age next birthday |

50,000.00

+ AF + Bonus |

Living

Assurance

Benefit

up to 65 age next birthday |

50,000.00

+ AF + Bonus |

Accidental

Total Permanent

Partial

Disability up to 65 age next birthday |

Up

to 50,000.00 |

Funeral

Expenses |

5,000 |

AF = Accumulated Fund, Minimum Guaranteed Return of 70% on total premium paid

!!! ADVANTAGES OF THIS SCHEME !!!

- Level Premium for all ages

- Affordable premium with comprehensive protection

- Monthly Premium payment through deduction from commission statement

- Participation of this scheme will end on reaching 70 Age Next Birthday.

- 70% Minimum Guaranteed Return plus bonus declared (if any) upon Maturity

- Cash Surrender Value

- Entitled for income tax relief

- No disruption of participation even after leaving GE as agent

36 Critical Illnesses (Living Assurance Benefit)

Living Assurance Benefit covers all the similar 36 Critical Illnesses as printed in the individual Great Eastern Life policies. Payment of this benefit is an advance of death benefit due to natural causes and the insurance cover ceases upon payment.

ELIGIBILITY AND PARTICIPATION

- Member and spouse who are 55 age next birthday and below can apply to participate.

- Member must participate before his/her spouse is eligible to participate.

- Children are also allowed to participate subject to the terms and conditions of children participation.

- Great Eastern reserves the right to terminate the scheme and pay the current cash value if the total number of participants falls below 500.

Conditions For Children s Participation

- Member and his/her spouse must participate first

- The child can only participate if the eligible legal spouse of the assured member is participating.

- A dependant s sum assured cannot exceed sum assured of member s spouse

- Failure to follow the above conditions will result in no benefits being payable on any claims for the assured child and cover will cease immediately with all received premiums (if any) refunded.

- Any child between the age of 15 days and 19 years, or up to 23 years if he is a full time student in institution of higher learning, is eligible to participate.

- Reduced Children s Benefit Amount (Lien) – Natural Causes Only

Age

Next Birthday |

1 |

2 |

3 |

4 |

5 |

Percentage

Of The Sum

Assured |

20% |

40% |

60% |

80% |

100% |

FURTHER DETAILS OF THE BENEFITS

Death (Age 70 next birthday) – Natural Causes

Total Permanent Disability (Age 65 next birthday) – Natural Causes

Death And Total Permanent Disability – Accidental Causes

- Death / TPD benefit is double the amount of Death/TPD due to natural causes and covered up to 65 age next birthday

- Other Permanent Partial Disability Benefits up to 65 age next birthday will be payable according to the Schedule of Compensation in the Master Policy

Accumulated Fund Benefit

- The Accumulated Fund basing on member s total contribution under this scheme will become payable on reaching age 70 or surrender whichever is earlier.

- Participation ceases on attaining age 70.

- No Surrender Value will become payable for less than 12 monthly premiums made

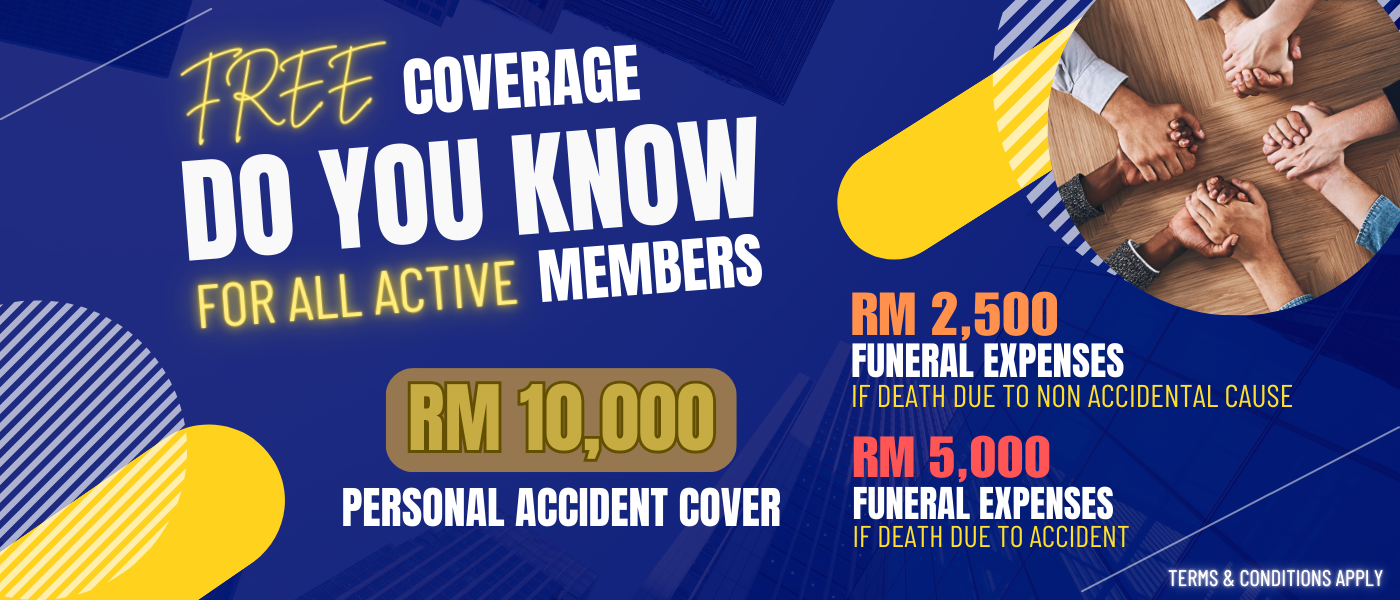

Funeral Expenses – RM5,000.00 is payable for Death Claim

Important Note:

- The information in this site is for illustration purposes only. The actual terms and conditions are contained in the Master Policy.

- You are strongly advised to read and understand the benefits and exclusions under the master policy held by the Association before signing this proposal form

For more information please do not hesitate to contact us at:

Tel: 03-9200 6300 | WhatsApp: 03-9200 6400

Email Address: gelfaam@gelfaam.com