Benefits of Membership

FIRST HAND INFO

Access to latest industry and company news through GELFAAM portal, www.gelfaam.com

GELFAAM ASSIST

Other than the objectives of the Association, assistance is being rendered to members to resolve any issue that may arise in the course of dealing with the company, Great Eastern Life, from contractual issue to daily operational and compliant matters. Association since inception, has successfully assisted many members to resolve a number of thorny issues!

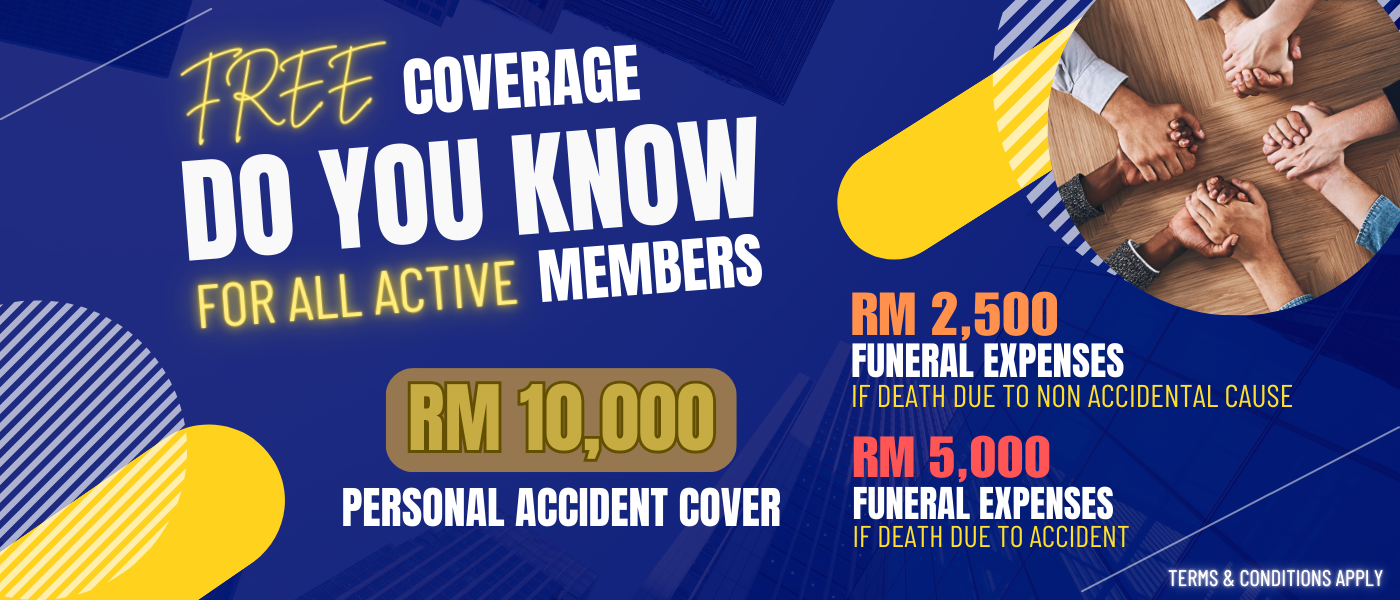

FREE PA

All active GELFAAM members are provided with a free world-wide & 24-hours RM10,000.00 personal accident insurance cover up to age 80. (Cover Accidental Death & TPD with RM5,000 funeral expenses – that is RM10,000.00 + RM5,000.00)

New!!! ………RM2,500 Funeral Expenses If death due to non-accidental causes

GROUP INSURANCE SCHEME

GELFAAM members together with family members have the option to subscribe either or all the competitive-premium-rated Group Insurance Schemes negotiated by the Association specially for the members such as

- G1009791 (formerly known as GS 724) – Group Yearly Renewable Term Assurance

(Cover Death or TPD due to sickness or accident)

Premium for RM150,000 sum assured is RM166.50/year (for age band below 35 ANB) - GS 166 (formerly known as GS 3462) – Group Multiple Benefits Insurance Scheme – Investment Link Product

(Cover Death, TPD and 36 Critical Illnesses – double indemnity for accidental death and TPD)

Premium: RM1.10 per month per RM1,000.00 sum assured - World-wide and 24-hour comprehensive Group Personal Accident Insurance Scheme

(This cover is extended to cover Accidental Death or Bodily Injury caused by or as a result of Drowning, Inhalation of Gas, Intoxication of Liquor, Food Poisoning, Snake and Insect Bites, Murder and Assault, Motor-Cycling, Amateur Sports, Disappearance, Exposure to Element)

Premium for RM100,000 sum insured is RM47.70/year(GST Included). Maximum sum insured is RM500,000 - GS 119 – Group Multiple Benefits Takaful Scheme – Investment Link Product

(Cover Death, TPD and 36 Critical Illnesses – double indemnity for accidental death and TPD)

Premium: RM1.00 per month per RM1,000.00 sum assured (for age band 36-50 ANB) - GS 265Y (Enhanced with Hospitalisation Benefits) – Group Multiple Benefits Insurance Scheme – Investment Link Product

(Cover Death, TPD and 36 Critical Illnesses – double indemnity for accidental death and TPD)

Premium: RM1.10 per month per RM1,000.00 sum assured

PROFESSIONAL INDEMNITY SCHEME

Professional Indemnity Insurance – Indemnifying against Legal liability to third parties due to your negligence in the provision of financial planning services.

Cover: Defence Costs and Expenses and extension to

- Libel & Slander

- Loss of Documents

- Retroactive Cover excluding known claim and circumstances

Premium: Only RM201.50 (excluding 6%GST) per annual for maximum RM200,000 coverage in any one claim and up to RM1,000,000 in any one policy period